Are you just starting your career as a self-taught investor? Learning

how to trade stocks is tricky at first. But thanks to technology, there

are many day trading applications available around that are especially

designed for beginners.

Take a look at the following top day trading software that will help you start your career in the stock trading market

Pros: Offers hundreds of fundamental and technical criteria in screening, can import data and graphs, can save webpage with a single tick for stock research. It allows you to create your own trading strategy. Very easy to use and effective in result

The StockVision – PowerScan is made to oversee more than 2,000 stocks in real time. Through this tool, you can immediately see the stocks you are closely watching for. The software is also capable of running daily and intraday scans. Afterwards, you can easily see the bar patterns of the scans for potential trading target.

Pros: With built-in data, customizable filters, allows sharing of filter with other traders, provides real time feedbacks.

Worden Telecharts is best for scanning stocks. It can provide a comprehensive view of promising pre-market stocks to watch for. The software’s pride is speed – it can produce reliable results for quick stock scans in just a matter of seconds. The software is also good at sorting databanks for a more simplified analysis of promising stocks.

Pros: Easy to install, fast scans, provides up-to-date technical analysis on stocks, comes with alerts and Watch lists.

QuoteTracker is famous for streamlining data feeds in real time. When launching the software, you can get real time insights of quotes, intraday charts and historical charts from the stock market. Its integrated trading has more than 120 technical indicators. Through the integrated data feeds, you can also have access to brokers, financial sites and latest economic news around the world.

Pros: Free to download, comes with advanced alert system, supports multiple portfolios, can print portfolios.

Ninja Trader is one of the best day trading software around. It supports manual, automated and semi-automated trading. It also offers trade simulator services so you can learn trading techniques in a risk-free setting. You can also manage advanced charting and market analytics with this software.

Pros: Free to download, with trade simulator, supports automated trading, allows custom development, supports third party library.

Jigsaw Trading specializes in providing day trading tools. The software simplified the reading of Order Flow so you can focus on making a trading decision rather than remembering previous data charts. The Order Flow is presented in a way that is easy to understand and you can freely select from the several intuitive formats offered.

Pros: Remarkable presentation of Order Flow, provides depth and sales insights, comes with free training, with superb trading community.

The Stock Rover application is basically an equity research tool. It screens for stocks that will fit your trading criteria. You can narrow down screening by using more than 300 financial metrics offered by the software. Afterwards, you can immediately compare stocks and manage your portfolios wisely.

Pros: With more than 300 financial metrics, with complete fundamental and technical information laid, supports filtering and grouping of stocks according to your own preference.

Charles Schwab offers the best tools that most professional day traders expect from premium trading programs. The software allows direct access to the Electronic Communications Network and supports smart order routing to NYSE and NASDAQ. Instead of charging one-time fee, Charles Schwab has service charges per transaction completed.

Pros: Supports high frequency trading, 24/7 online support, offers the best price in the market when buying and selling securities, with plenty of professional tools for day trading.

RealTick helps in facilitating trading across global markets. It caters to online traders, brokers and financial institutions in generating market analysis and liquidity solutions. The software is equipped with advanced trading tools so it will be easier to manage risk in online trading.

Pros: Intuitive user interface, lists comprehensive data reports, equipped with advanced trading tools, software setting configurable to fit trading needs.

eSignal has been popular for its unique data streaming technology. Over the years, they have mastered how to craft smart trading tools for day traders. Its charting, scanning and analyzing tools are fully responsive and can provide real time insights during day trading. The charts in the software are fully customizable as well in order to meet everyone’s trading needs.

Fill this form to get free demo of Automated trading systems

Take a look at the following top day trading software that will help you start your career in the stock trading market

10. Online Robotic Stock Trader

The Online Robotic Stock Trader software allows users to search and plan their trades ahead of time. It has the ability to screen for Technical Chart Patterns and Candlestick Patterns. This system provides you the best stock trading strategies which can help traders during their trading. Its charting, scanning and analyzing tools are fully responsive and can provide real time insights during day trading. The charts in the software are fully customizable as well in order to meet everyone’s trading needs.Pros: Offers hundreds of fundamental and technical criteria in screening, can import data and graphs, can save webpage with a single tick for stock research. It allows you to create your own trading strategy. Very easy to use and effective in result

9. StockVision – PowerScan

The StockVision – PowerScan is made to oversee more than 2,000 stocks in real time. Through this tool, you can immediately see the stocks you are closely watching for. The software is also capable of running daily and intraday scans. Afterwards, you can easily see the bar patterns of the scans for potential trading target.

Pros: With built-in data, customizable filters, allows sharing of filter with other traders, provides real time feedbacks.

8. Worden Telecharts

Worden Telecharts is best for scanning stocks. It can provide a comprehensive view of promising pre-market stocks to watch for. The software’s pride is speed – it can produce reliable results for quick stock scans in just a matter of seconds. The software is also good at sorting databanks for a more simplified analysis of promising stocks.

Pros: Easy to install, fast scans, provides up-to-date technical analysis on stocks, comes with alerts and Watch lists.

7. QuoteTracker

QuoteTracker is famous for streamlining data feeds in real time. When launching the software, you can get real time insights of quotes, intraday charts and historical charts from the stock market. Its integrated trading has more than 120 technical indicators. Through the integrated data feeds, you can also have access to brokers, financial sites and latest economic news around the world.

Pros: Free to download, comes with advanced alert system, supports multiple portfolios, can print portfolios.

6. Ninja Trader

Ninja Trader is one of the best day trading software around. It supports manual, automated and semi-automated trading. It also offers trade simulator services so you can learn trading techniques in a risk-free setting. You can also manage advanced charting and market analytics with this software.

Pros: Free to download, with trade simulator, supports automated trading, allows custom development, supports third party library.

5. Jigsaw Trading

Jigsaw Trading specializes in providing day trading tools. The software simplified the reading of Order Flow so you can focus on making a trading decision rather than remembering previous data charts. The Order Flow is presented in a way that is easy to understand and you can freely select from the several intuitive formats offered.

Pros: Remarkable presentation of Order Flow, provides depth and sales insights, comes with free training, with superb trading community.

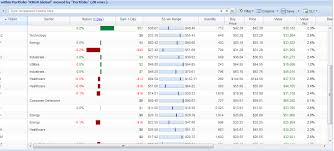

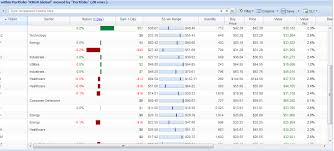

4. Stock Rover

The Stock Rover application is basically an equity research tool. It screens for stocks that will fit your trading criteria. You can narrow down screening by using more than 300 financial metrics offered by the software. Afterwards, you can immediately compare stocks and manage your portfolios wisely.

Pros: With more than 300 financial metrics, with complete fundamental and technical information laid, supports filtering and grouping of stocks according to your own preference.

3. Charles Schwab

Charles Schwab offers the best tools that most professional day traders expect from premium trading programs. The software allows direct access to the Electronic Communications Network and supports smart order routing to NYSE and NASDAQ. Instead of charging one-time fee, Charles Schwab has service charges per transaction completed.

Pros: Supports high frequency trading, 24/7 online support, offers the best price in the market when buying and selling securities, with plenty of professional tools for day trading.

2. RealTick

RealTick helps in facilitating trading across global markets. It caters to online traders, brokers and financial institutions in generating market analysis and liquidity solutions. The software is equipped with advanced trading tools so it will be easier to manage risk in online trading.

Pros: Intuitive user interface, lists comprehensive data reports, equipped with advanced trading tools, software setting configurable to fit trading needs.

1. eSignal

eSignal has been popular for its unique data streaming technology. Over the years, they have mastered how to craft smart trading tools for day traders. Its charting, scanning and analyzing tools are fully responsive and can provide real time insights during day trading. The charts in the software are fully customizable as well in order to meet everyone’s trading needs.

Fill this form to get free demo of Automated trading systems